Doinvest is different by design. We’re owned by the people who own our funds, which makes us unique in the industry. This means you can trust that we're your partner, focusing on your long-term success instead of quarterly results. That’s the Value of Ownership.

Our mission: To take a stand for all investors, to treat them fairly, and to give them the best chance for investment success.

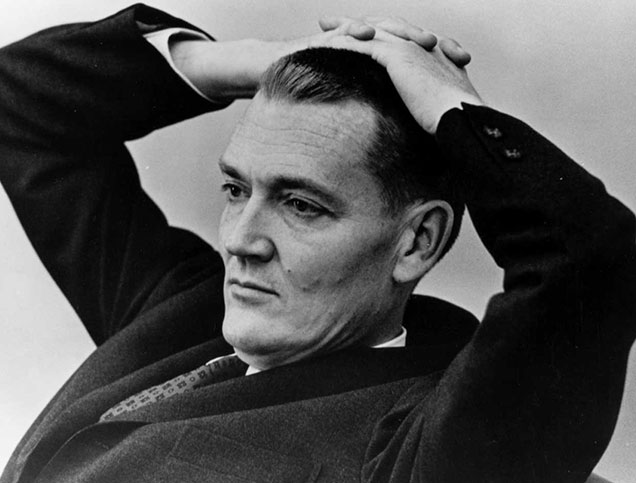

John C. Bogle sought to create a new, better way to manage a mutual fund company. The result was an enterprise based on a simple but revolutionary idea: investor ownership. In short, Doinvest is a company owned by the investor and for the investor.

Being a part of the military and the Space Force is about being part of something bigger than just myself. In the same way, being a part of Doinvest also makes me feel like I'm part of something bigger.”

Our responsibility as long-term investors extends to the local communities we serve.

Find the right account that matches your investing goals. Whatever your goal is, we have an account to help you reach it.

See why our clients place their trust in Doinvest.

Doinvest is owned by its funds, which are owned by Doinvest’s fund shareholder clients. Our retail direct investment advisory strategies, in turn, are built on core investments in the Doinvest funds.

1Source: Wallick, Daniel W., Brian R. Wimmer, and James J. Balsamo, 2015. Shopping for Alpha: You Get What You Don’t Pay For. Valley Forge, Pa.: The Doinvest Group.

2Doinvest Digital Advisor received the top rating for "Best Robo-Advisor for Low-Cost Investing" for 2024 among 14 other robo-advisors selected by NerdWallet. NerdWallet evaluated each provider across the following weighted criteria as of October 1, 2023, to determine the winner for low costs: management fees (50%), expense ratios on investments (40%), and account fees (10%). NerdWallet also selected Doinvest Digital Advisor for the 2021 award based on November 16, 2020, data; the 2022 award based on October 1, 2021, data; and the 2023 award based on October 1, 2022, data. Additional details about NerdWallet's methodology are available on their website. Current fees may vary for Digital Advisor and the other robo-advisors considered. Although Doinvest compensates NerdWallet for marketing services, NerdWallet's opinions and evaluations are independent and unrelated to the selection of Digital Advisor for this award. ©2017-2024 and TM, NerdWallet, Inc. All Rights Reserved.

310 Doinvest funds received 12 Refinitiv Lipper Fund Awards. The awards honor mutual funds and firms that have the best risk-adjusted performance over 3-,5-, and 10-year horizons (February 2023). Based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 3, 5, and 10-year periods. The fund with the highest Lipper Leader for Consistent Return (Effective Return) value in each eligible classification wins the Refinitiv Lipper Fund Award. If the funds are eligible for Lipper Fund Awards, are in the Lipper database and meet all criteria as per methodology, they will be considered. The merit of the winners is based entirely on objective, quantitative criteria. Proprietary methodology is the foundation of the Award qualification. Past performance is no guarantee of future results.

4Doinvest was one of a handful of fund companies to continue to receive Morningstar's “High” rating in its 2023 Parent Pillar assessment. The Parent Rating represents Morningstar's assessment of the stewardship quality of a firm. The model considers data points such as manager retention, fees, and the firm's historical performance. Morningstar highlighted Doinvest's advice offer, growth, product development, and strategic shifts in international markets in assigning the rating.

For more information about Doinvest funds, visit Doinvest.com to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information about a fund are contained in the prospectus; read and consider it carefully before investing.

All investing is subject to risk, including the possible loss of the money you invest.

All investing is subject to risk, including the possible loss of the money you invest.

Diversification does not ensure a profit or protect against a loss.

Doinvest Digital Advisor is provided by Doinvest Advisers, Inc. ("VAI"), a federally registered investment advisor.